Modern digital transformation has automated businesses in every aspect including invoice management. The basic solution known as e-invoicing software provides invoicing streamlining capabilities for every company size in order to eliminate errors and optimize cash flow. Business organizations need to understand what e-invoicing software entails while selecting their solution. We will understand the fundamentals of e-invoicing software systems before focusing on significant features that provide improved results.

What Is E-Invoicing Software?

The digital world transforms at a quick pace so businesses adopt automation which includes invoice management as well. Business organizations of all sizes use the fundamental E-invoicing software solution to enhance their invoicing workflow by decreasing mistakes while permitting stronger cash flow administration. The basics of e-invoicing software together with the main criteria that business organizations utilize during solution selection form the focus of this text. A detailed explanation about e-invoicing software comes first followed by essential features which transform the entire process.

The digital E-invoicing software provides automated systems to handle all invoice-related activities through electronic techniques from creation to distribution to follow-up to administration. Modern electronic invoicing differs substantially from paper-based counterparts because it simplifies all business processes to enhance speed and precision while demonstrating environmental friendliness. With e-invoicing software companies enjoy both accounting and ERP system integration that captures real-time transactions accurately.

What to Look for in E-Invoicing Software?

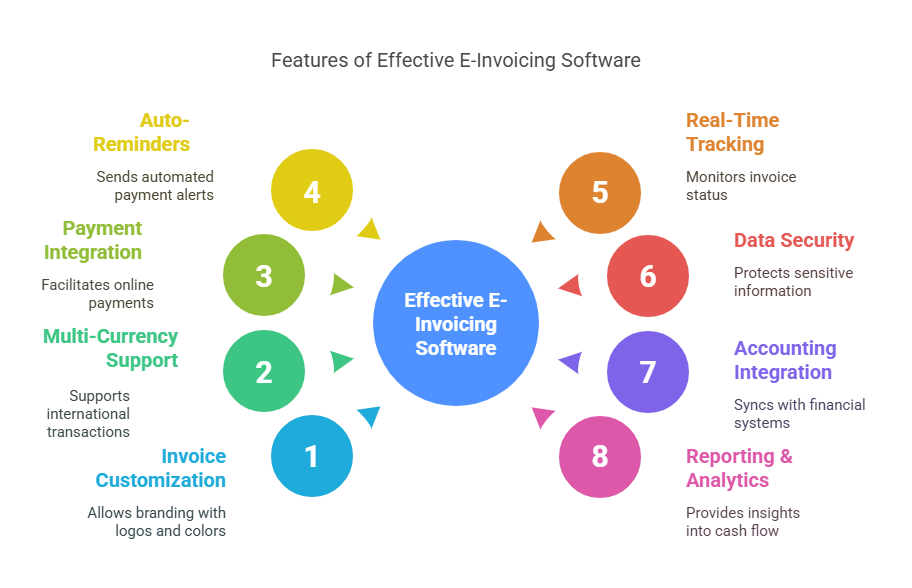

Organizations that implement e-invoicing software eliminate manual workloads that eat up employee working hours and lower mistakes while bringing additional value added services. Companies benefit from these platform features when they need payment reminders combined with currency management support in addition to their invoicing system.

1. Automated invoice creation and customization

Your procurement of e-invoicing software should deliver simple customization options for professionally formatted invoices through its templates. Businesses can make invoices their own by adding brand logos along with company-specific colors and particular design elements to produce professional invoices with corporate branding. Automated invoice generation remains essential because businesses need simple invoice creation tools which eliminate human errors that manual entries would bring.

2. Multi-Currency and Multi-Language Support

Businesses operating with international clients need mandatory features which include multi-currency and multi-language functions. E-invoicing software equips businesses to generate calls for payment in the preferred currency and language of their clients through multi-currency and multi-language functionality. The invoice system streamlines international business deals while cutting down currency exchange complications to deliver a seamless invoicing process for customers.

3. Payment Integration Options

Clients can perform online payments through integrated payment options that exist within the invoice through E-invoicing solutions. This procedure makes payment acquisition faster since it eliminates the multiple stages normally required for completing payment transfers. Electronic invoicing service providers link their payment options to major gateway solutions that incorporate PayPal and Stripe and credit card processing systems so customers can select from all available modes of payment during checkout. The payment option addition provides customers better payment processing alternatives together with faster collection times that create a more stable business cash flow.

4. Auto-Reminders for Payments

Manual payment follow-ups for overdue invoices take up valuable time despite payment failures sometimes occurring. E-invoicing software equipped with an automated payment reminder system will notify clients gently both before and after payment deadlines. The automated payment reminder system cuts down business payment pursuit efforts, which leads to prompter cash flow collection processes with minimized staff workload.

5. Real-Time Tracking and Status Update

The requirements vary among different locations and specify certain criteria. The system needs to uphold all legal standards to stay clear of legal complications. An e-invoice compliance software automatically adjusts invoices to fulfill the specific requirements and format criteria set by states for GST or VAT along with other e-invoicing rules. The system's automated tax calculation feature reduces both incorrect tax accounting and any failure to meet tax obligation requirements. Both data security and privacy control installations become possible through this method.

The e-invoice software must contain built-in data security systems for safeguarding the highly confidential financial information that appears on invoices. You should pick software tools that offer full encryption services alongside robust login security protocols along with access privileges for different user roles. The data protection act must be followed by your system so your data alongside customer trust can survive.

6. Ease of Integration with Accounting Software

The e-invoice software must connect seamlessly with accounting and ERP systems to create a smooth transfer of financial information. The automated synchronization between invoice data and books makes financial record handling and auditing with report generation easier without manual data entry into books. The system delivers a full overview of financial operations while reducing mistakes within the overall framework.

7. Customizable Reporting and Analytics

Better insights about invoicing and cash flow become accessible with this system. The reporting and analytics features in the system are highly customizable for enhanced utility. The advanced analytics feature of e-invoice software helps businesses monitor payment deadlines as well as determine both payment duration statistics and their clients' payment-related activities. The insights generated from data allow organizations to implement decision-making through data and transform their payment habits and cash flow patterns.